In the rapidly evolving business and technology landscape, Artificial Intelligence (AI) has emerged as a powerful tool for transforming various sectors, including finance. One of the critical applications of AI in this domain is streamlining financial data extraction. This blog post explores the role of AI in financial data extraction, focusing on data analytics, AI algorithms, financial services, databases, and machine learning.

Data Analytics

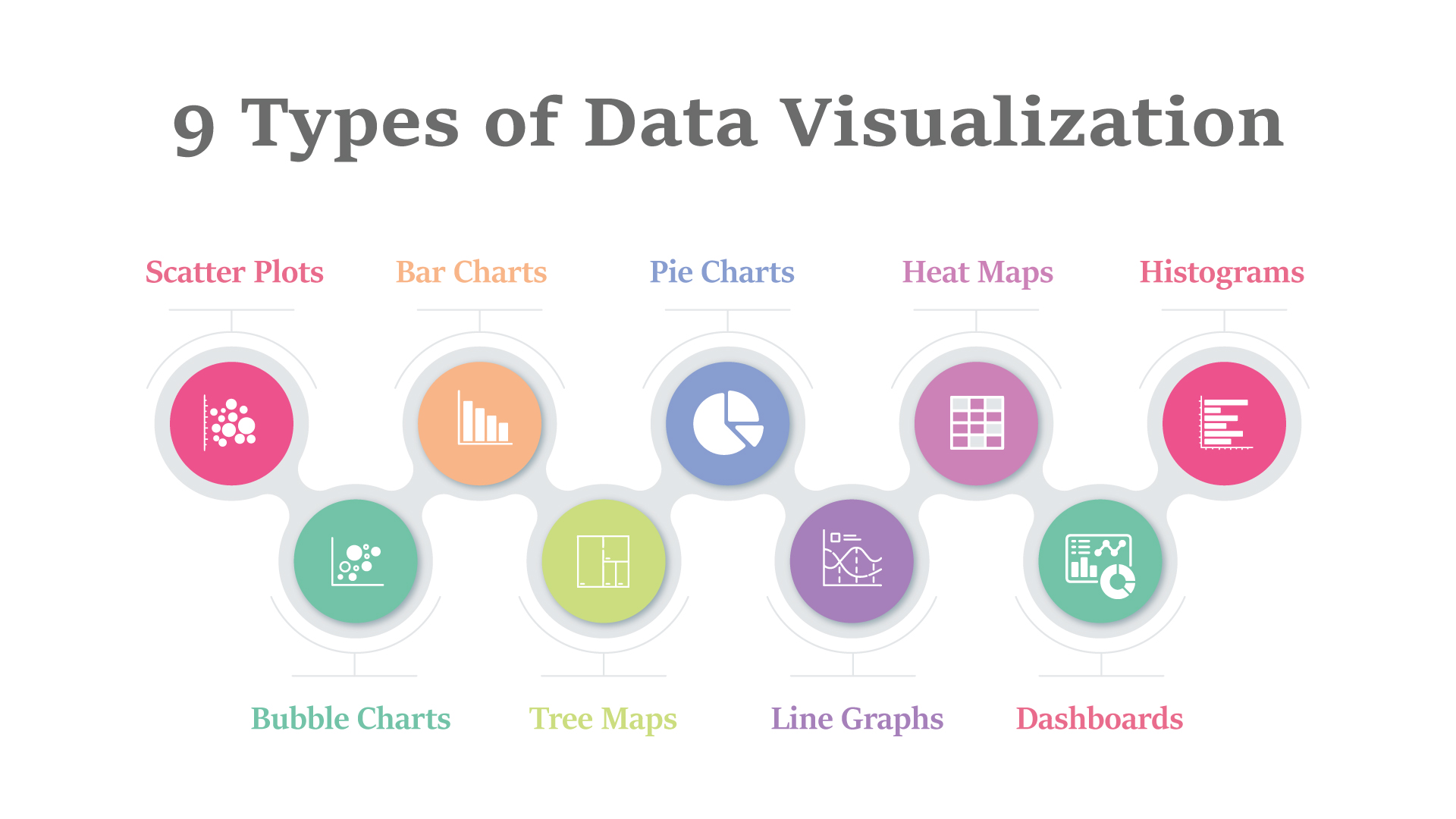

Data analytics in finance involves analyzing vast amounts of data to identify patterns, trends, and insights that can guide decision-making. Traditionally, this process was manual and time-consuming. AI has revolutionized data analytics by automating data extraction and analysis, making it faster and more accurate.

AI-powered data analytics tools can process structured and unstructured data from various sources, including financial statements, transaction records, and market data. These tools use advanced algorithms to identify anomalies, predict trends, and provide actionable insights.

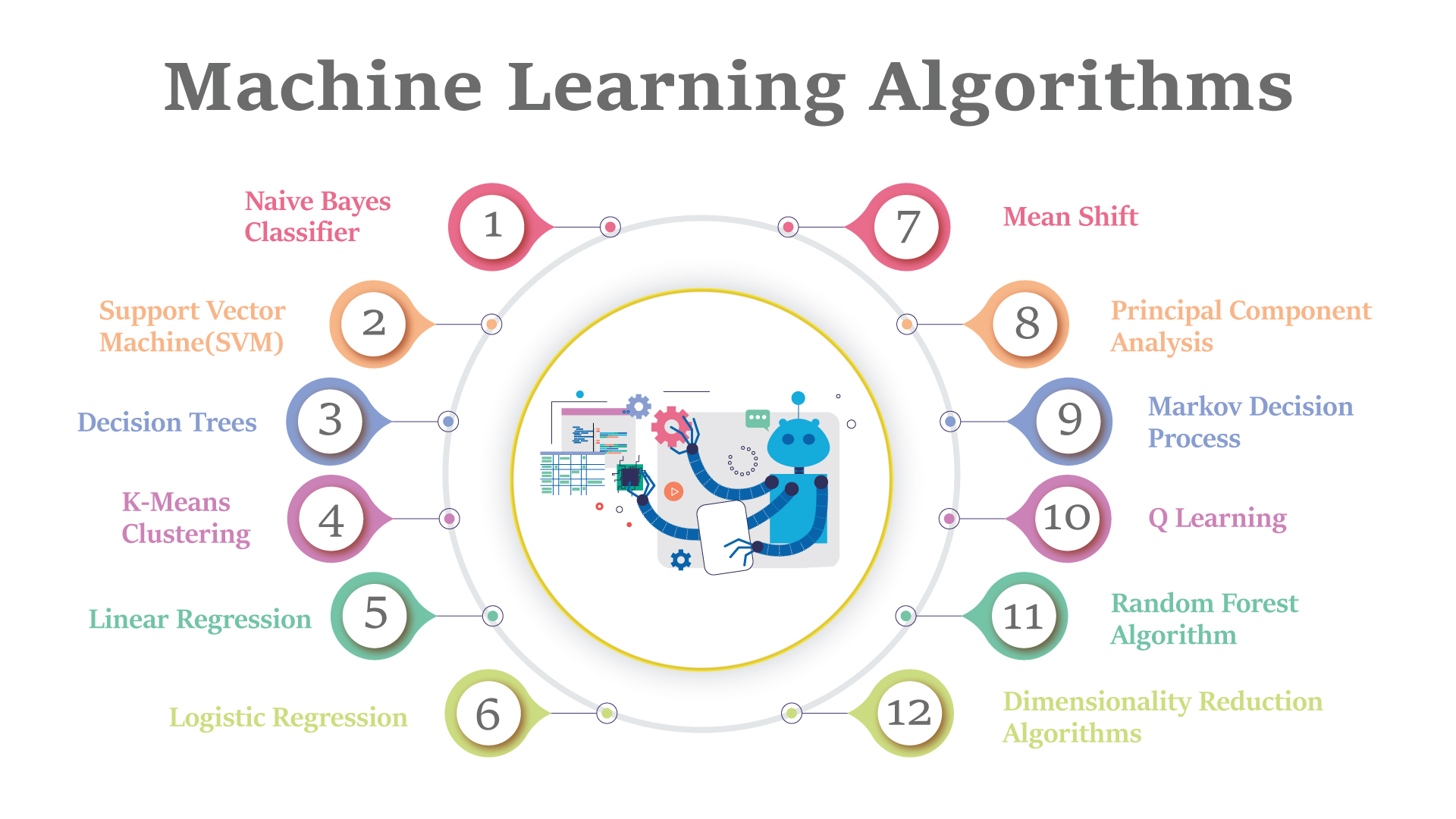

| Algorithm | Description |

| Linear Regression | Models the relationship between a dependent variable and one or more independent variables. |

| Logistic Regression | Used for binary classification problems by modeling the probability of a binary outcome. |

| Decision Trees | A tree-like model of decisions used for classification and regression tasks. |

| Random Forest | An ensemble method that uses multiple decision trees to improve predictive performance. |

| K-Nearest Neighbors (KNN) | A simple, instance-based learning algorithm used for classification and regression. |

| Support Vector Machines (SVM) | A supervised learning algorithm used for classification by finding the hyperplane that best separates classes. |

| Naive Bayes | A probabilistic classifier based on Bayes’ theorem with an assumption of independence among predictors. |

| K-Means Clustering | A centroid-based clustering algorithm that partitions data into K distinct clusters. |

| Hierarchical Clustering | A method of cluster analysis which seeks to build a hierarchy of clusters. |

| Principal Component Analysis (PCA) | A dimensionality reduction technique that transforms data into a set of orthogonal components. |

| Association Rule Learning | A rule-based machine learning method for discovering interesting relations between variables in large databases. |

| Time Series Analysis | Techniques used to analyze time-ordered data points to extract meaningful statistics and characteristics. |

| Gradient Boosting Machines (GBM) | An ensemble technique that builds models sequentially to correct the errors of the previous models. |

| Neural Networks | A set of algorithms modeled loosely after the human brain, designed to recognize patterns. |

| Reinforcement Learning | A type of machine learning where an agent learns to make decisions by receiving rewards or penalties. |

For instance, AI can analyse market conditions and predict stock price movements, enabling businesses to make informed investment decisions.

AI Algorithms

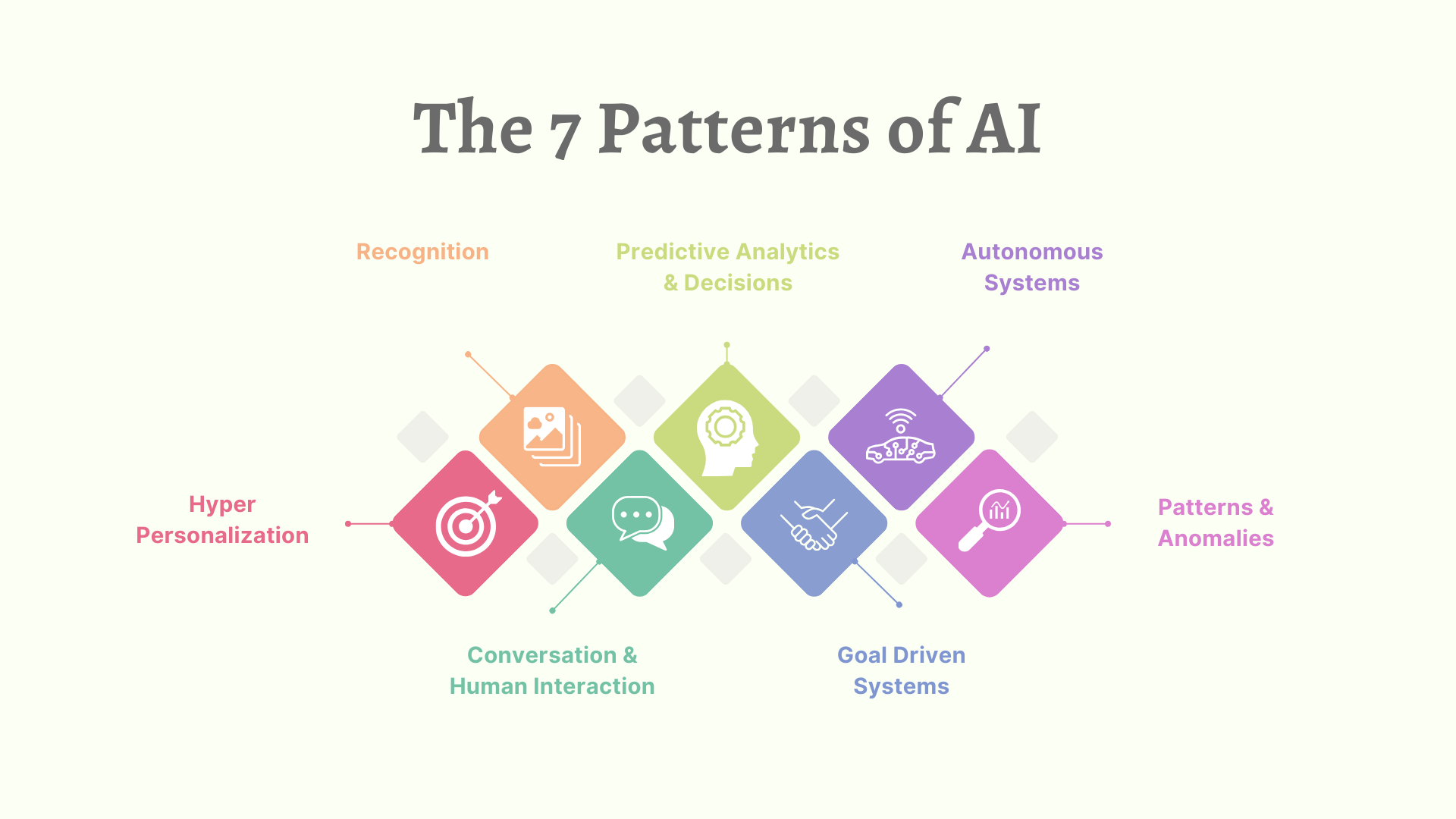

AI algorithms are at the heart of AI-powered financial data extraction. These algorithms are designed to mimic human intelligence and can perform tasks such as pattern recognition, natural language processing (NLP), and machine learning.

1. Pattern Recognition

AI algorithms can identify patterns in large datasets that are beyond human capability. For example, they can detect fraudulent transactions by recognizing unusual spending patterns.

2. Natural Language Processing (NLP)

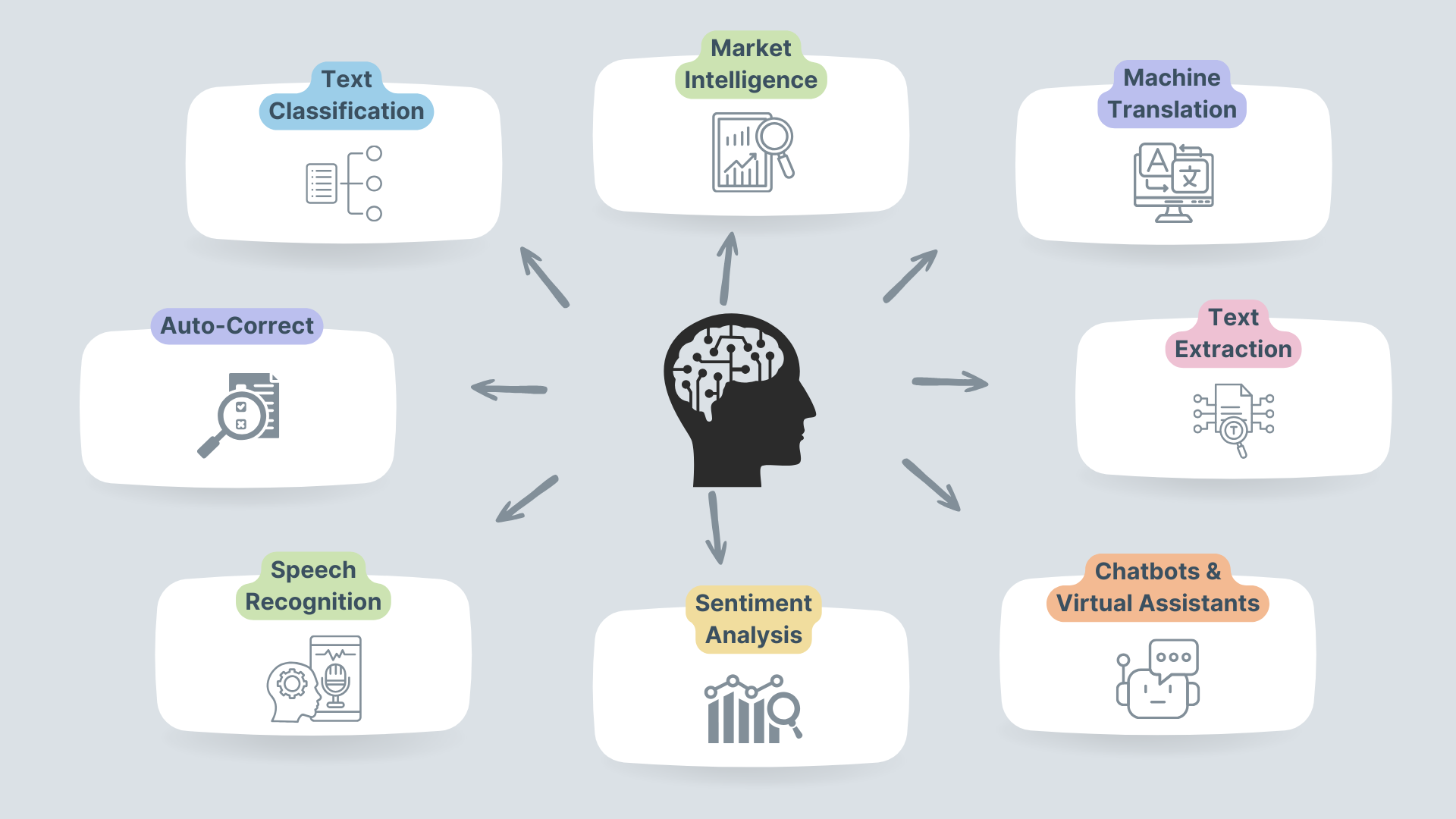

NLP algorithms enable AI systems to understand and interpret human language. This is particularly useful in extracting data from unstructured sources such as emails, contracts, and financial reports. NLP can convert this unstructured data into a structured format that can be easily analyzed.

3. Machine Learning

Machine learning algorithms allow AI systems to learn from data and improve their performance over time. In financial data extraction, machine learning can be used to predict future trends based on historical data, providing businesses with valuable foresight.

Financial Services

AI has a significant impact on various financial services, including banking, investment management, and insurance. By streamlining data extraction, AI enhances efficiency, reduces costs, and improves accuracy in these services.

- Banking: AI is used to automate tasks such as credit scoring, loan approval, and risk management. For instance, AI can analyze a customer’s financial history and provide a credit score within seconds, reducing the time required for loan approval.

- Investment Management: AI helps investment managers by providing real-time analysis of market conditions and predicting future trends. This enables them to make better investment decisions and maximize returns.

- Insurance: In the insurance sector, AI streamlines the claims processing by extracting and analyzing data from claim forms, medical reports, and other documents. This reduces the time and cost associated with claim processing and improves customer satisfaction.

Data Extraction

Data extraction is the process of retrieving data from various sources and converting it into a structured format for analysis. AI streamlines this process by automating data collection, cleaning, and transformation.

1. Automated Data Collection

AI tools can automatically collect data from multiple sources, including financial statements, transaction records, and market data. This reduces the time and effort required for manual data collection.

Benefits

- Improved Accuracy and Consistency: AI tools can collect data with a high degree of accuracy and consistency, reducing human errors that may occur during manual data entry or extraction.

- Time Efficiency: By automating data collection, businesses save time that would otherwise be spent on manual data gathering processes. This allows employees to focus on more strategic tasks and decision-making.

- Real-time Insights: Automated data collection enables businesses to access and analyze data in real-time or near real-time. This timely access to information can facilitate quicker decision-making and response to market changes.

2. Data Cleaning

AI algorithms can identify and correct errors in the data, ensuring that the data is accurate and reliable. This is particularly important in financial data extraction, where errors can lead to incorrect analysis and decisions.

Benefits

- Improved Data Accuracy: AI algorithms can detect and correct errors in data more effectively than manual methods. This ensures that the data used for analysis and decision-making is accurate and reliable, reducing the risk of making decisions based on flawed information.

- Enhanced Decision-Making: Clean and accurate data enables better decision-making processes. Businesses can rely on trustworthy insights derived from clean data to formulate strategies, optimize operations, and allocate resources effectively.

- Cost Savings: Correcting errors in data early through AI-driven cleaning processes can prevent costly mistakes down the line. For instance, in financial data, accurate reporting can help avoid compliance issues, fines, and operational disruptions.

3. Data Transformation

AI can transform unstructured data into a structured format that can be easily analyzed. For instance, NLP algorithms can convert text from financial reports into structured data that can be used for analysis.

Benefits

- Enhanced Data Utilization: AI can transform unstructured data, such as text from financial reports or customer feedback, into structured formats that are easier to analyze. This transformation enables businesses to extract valuable insights and trends from data sources that were previously difficult to utilize effectively.

- Improved Decision-Making: Structured data derived from AI-driven transformation allows for more informed and data-driven decision-making processes. Businesses can analyze historical trends, identify patterns, and make predictions based on accurate data representations.

- Operational Efficiency: By automating the transformation of unstructured data into structured formats, AI reduces the manual effort and time required for data preparation. This efficiency gains allow employees to focus on higher-value tasks such as analysis and strategic planning.

Databases

Databases play a crucial role in financial data extraction as they store and manage large volumes of data. AI enhances database management by providing advanced data extraction and analysis capabilities.

- Database Management Systems (DBMS): AI-powered DBMS can automate tasks such as data indexing, query optimization, and data retrieval. This improves the efficiency and performance of databases.

- Data Warehousing: AI can optimize data warehousing by automating data extraction, transformation, and loading (ETL) processes. This ensures that the data in the warehouse is accurate, up-to-date, and ready for analysis.

- Data Integration: AI can integrate data from multiple sources, providing a unified view of the data. This is particularly useful in financial data extraction, where data is often spread across different systems and formats.

Machine Learning

Machine learning is a subset of AI that enables systems to learn from data and improve their performance over time. In financial data extraction, machine learning is used to enhance data analysis and prediction capabilities.

1. Predictive Analytics

Machine learning algorithms can analyze historical data and predict future trends, enabling businesses to make informed decisions. For instance, machine learning can predict stock price movements, helping investors to maximize returns.

Benefits

- Anticipating Customer Behavior: By analyzing past customer data, predictive analytics can forecast future customer behavior such as purchasing patterns, product preferences, and churn likelihood. This insight enables businesses to tailor marketing strategies, personalize customer interactions, and improve customer retention efforts.

- Optimizing Marketing Campaigns: Predictive analytics can identify the most effective marketing channels, timing, and messaging based on historical data and customer segmentation. This optimization helps businesses allocate marketing resources more efficiently, improve campaign ROI, and attract new customers effectively.

- Enhancing Risk Management: Predictive analytics models can assess risk factors and predict potential risks such as credit defaults, fraudulent activities, or equipment failures. This capability allows businesses to implement proactive risk mitigation strategies, improve decision-making in risk assessment, and minimize potential losses.

2. Anomaly Detection

Machine learning can identify anomalies in financial data, such as fraudulent transactions or unusual spending patterns. This enhances the accuracy and reliability of financial data analysis.

Benefits

- Fraud Detection: In industries such as banking, insurance, and e-commerce, anomaly detection algorithms can identify unusual transactions or behaviors that may indicate fraudulent activities. By flagging suspicious activities in real-time, businesses can prevent financial losses and protect customers.

- Network Security: Anomaly detection is essential for monitoring network traffic and identifying unusual patterns that may signify security breaches, malware infections, or unauthorized access attempts. Early detection allows businesses to take corrective actions promptly to safeguard sensitive data and prevent disruptions.

- Quality Control: In manufacturing and production environments, anomaly detection can identify deviations in product quality or defects early in the production process. This capability enables businesses to take corrective actions promptly, reduce waste, and maintain high-quality standards.

3. Automation

Machine learning automates repetitive tasks such as data collection, cleaning, and transformation, reducing the time and effort required for these tasks.

Benefits

- Enhanced Accuracy and Consistency: Automated processes eliminate the variability and errors that can occur with manual tasks. This ensures consistent quality in outputs, particularly in data entry, reporting, and customer service interactions.

- Faster Response Times: Automation enables faster response times in customer service, order processing, and other operational areas. This speed enhances customer satisfaction and competitive advantage in the marketplace.

- Scalability: Automated systems can easily scale with business growth and increasing workload demands. Whether it’s processing orders, handling customer inquiries, or managing inventory, automation provides flexibility and scalability.

The Impact of AI on Financial Data Extraction: Final Thoughts

AI is transforming financial data extraction by automating data collection, cleaning, and analysis, making the process faster, more accurate, and more efficient. By leveraging AI algorithms, data analytics, and machine learning, businesses in the financial sector can gain valuable insights, improve decision-making, and enhance operational efficiency. As AI continues to evolve, its role in streamlining financial data extraction will only become more significant, driving innovation and growth in the financial services industry.